Powell Sticks With Taper as NASDAQ Bleeds!

‘So many in the venture capital business are sheep that just want to follow the herd. They are momentum investors purchasing highly illiquid investments. That is a recipe for disaster.’ Fred Wilson

Many years ago, I was asked to consult with a couple of venture capital partners. Essentially, those two individuals decided it would be worth their time to extract as much information as possible about asset management as they could. My time was not valuable to them, and ultimately, their supposed partnership turned to dust. Another skeptic of the venture industry was the founder of a company whose entity would up being sold for a billion dollars. His experience was similar to mine because those he encountered strung him along and his time (money) was wasted. The moral of the stories is one should be very wary of the venture capital industry. You probably could say the same thing about a lot of leaders and professions these days. Taking advantage of others without just compensation is prevalent all throughout society. It is for good reason one should be very careful about who you decide to work with, or not.

The reason why I bring up venture capitalists is because Silicon Valley has long been dominant in funding startup companies. There are about five or ten top firms which have created enormous wealth for their clients, usually very wealthy pools of capital (pension funds, foundations, and endowments). For competing asset management firms, especially a small one like mine, the astronomical returns by the venture firms are very high hurdles in attracting institutional investors. The largest venture firms know their returns and they use it to their advantage in attracting capital. They also use it in the way they structure their ownership stakes of the startups they allocate capital to. The dual class structure and ability to only sell a small percentage of shares when one of their startups go public ensures very large returns when one of their portfolio companies successfully gets listed. All that works wonderfully during a good market, or when the environment is placid. Given we have been in this situation for nearly fifteen years, well, the IPO area attracted huge amounts of capital over the last decade. Still, very little in the world has unlimited staying power, and it could be the case that the ideal climate for venture capital is over. Why do I say this?

Over the last month, many high profile NASDAQ companies have lost a tremendous amount of value. Much of the decline has taken place over the last two weeks as investors are starting to believe Fed Chairman Powell will be more aggressive about fighting inflation than previously thought. It certainly would be understandable to question Powell’s commitment to a more hawkish posture. For over a decade, investors have seen the last three Fed heads keep interest rates at historically low levels. With markets up twenty percent in 2021 after having a great run for a long period, it certainly would make sense that Jerome isn’t going to be in any hurry to rock the boat. His hand may be forced by accelerating inflation, and this is what is bothering investors.

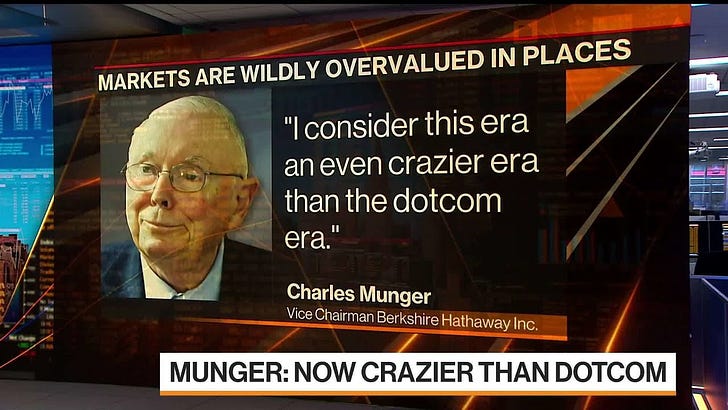

The central problem in the situation is the gains some of these companies have been afforded relative to the size and profitability of the existing business. You can list many companies which aren’t just given billion, five billion, or ten billion dollar valuations. In the everything is worth infinity market, why stop there? Make up the number, 50 billion, 100 billion, 500 billion, a trillion, 3 trillion. Space companies and electric car companies never having sold a vehicle are the prime examples, but there are plenty of others. As part of this, and a massive movement, is the cryptocurrency area. Doge-coin, done as a spoof, is worth billions. Everything is worth infinity. Until interest rates aren’t zero (or close to zero- now 1.5% on the 10 year). Yesterday, about as accurate of a judge of markets as exists, Charlie Munger, opined on the current state of affairs. As interest rates go away from zero and in the opposite direction, the everything is worth infinity market starts to evaporate. When it does, more traditional metrics of valuing business take hold. There are many companies that are venture backed which are exceptional businesses. Not all are, and the ones that aren’t will be exposed as such when the interest rate environment changes.

In the markets last week, the November jobs report badly missed estimates with 210k jobs created versus the estimate of 550k. More cases of the Omicron variant spread across the globe as investors remain jittery over the near term effect. Docusign and Salesforce missed estimates with the former really taking it on the chin, losing over 40% of its value on Friday. In the oil market, OPEC countries decided to continue with a production boost as jumbled Joe needs their help to contain energy prices. Mr. Biden also faces the prospect of potentially more aggressive adversaries in China and Russia. China buzzed Taiwan with a much larger air force presence and Vlad decided to build up force levels on the Ukraine border. Things aren’t going swimmingly here in the United States as Mr. Biden’s approval rating rests in the 35-40% range. Imagine what it would be if the stock market weren’t up 20%, eh? Don’t think Jerome isn’t aware of this fact, either.

Yale Bock, Y H & C Investments, its clients, and the family of Yale Bock have positions in the securities mentioned in the blog, Investing in securities involves risk and the potential loss of ones principal. Past performance is no guarantee of future results. All investment decisions should be considered with respect to ones risk tolerance, return objectives, liquidity needs, tax considerations, and one’s overall financial situation. The fact that Yale Bock has earned the right to use the CFA designation does not mean Y H & C Investments will outperform broad market indexes.