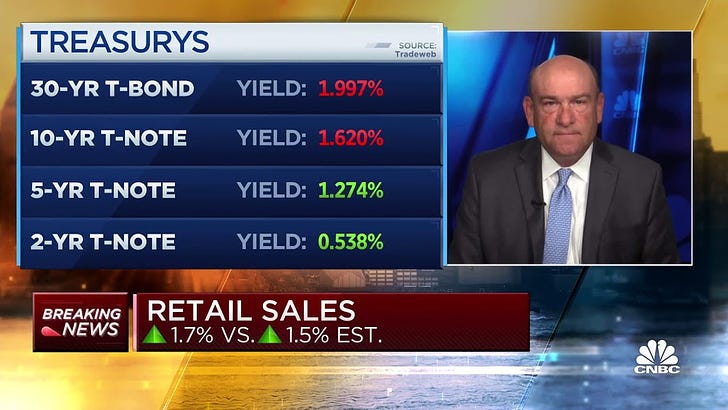

Strong Retail, Wal-Mart, and Tech Bolster Markets As Oil Slumps On Covid Europe Bump!

“If you think Independence Day is America’s defining holiday, think again. Thanksgiving deserves that title, hands-down.” —Tony Snow

During the next week, most Americans will be preparing for and then celebrating Thanksgiving. It is the quintessential American holiday. Families gather with their loved ones and friends for the sole purpose of spending time with each other and eating. What could be better? When you add sports to the mix, well, it happens to be a really great day. Part of thanksgiving is the inevitable travel which goes along with it. You see, Wednesday is the busiest travel day of the year. Airports and roads are jammed packed. It is no wonder as grandma’s stuffing, mashed potatoes, and pumpkin pie are waiting. There is another important item which uses Thanksgiving as the line of demarcation. It is called Black Friday, the day after when holiday shopping starts in earnest. We all know this has been pushed forward earlier and earlier, but it remains a big day on the business calendar.

From a seasonal perspective, retailers know how critical the holiday time frame is for their yearly profits. In the financial markets, this time of year begins a period where markets usually rally. Investment banks line up plenty of stock and bond underwriting business. As the year winds down, companies use the year end as an opportunity to buy whatever is needed for the upcoming year. If there is a deduction out there to be had, now is the time to find a reason to buy that piece of equipment. It is amazing how accelerated depreciation can be a motivating factor. Advertising usually sees a big push as the end of the year is applicable in that area as well. All of these factors come together to combine for a quarter which is typically pretty strong.

In the markets last week, the big news came from Wal Mart as it beat earnings expectations. Two big tech titans, NVIDIA and Intuit blew past their estimates and helped the NASDAQ finish on an upbeat tone. In the media space, Liberty held their annual investor conference. For many years I attended the event, which is always run extremely well and in a first class manner. A few years ago I decided I was quite familiar with Liberty and didn’t need the hassle of traveling to the east coast when the weather could become pretty difficult. Still, it is always a good idea to pay attention to what Liberty is doing. You might watch the clip with Malone’s opinion on the current state of the market. I believe the term he uses is ‘land grab.’

On that note, next week will be a rather abbreviated schedule with Thursday an off day. I hope all readers travel safe and have a wonderful Thanksgiving with your family and friends.

Thank you for reading the blog this week, and if you have any questions about investing, please email me at information@y-hc.com.

If you know of anyone who could use our investment advice, please don’t be afraid to reach out or pass their name along.

If you would like a free consultation regarding your portfolio, click here to set one up!

Interested in finding out your investment style? Take an investment assessment from Positivly!

Yale Bock, Y H & C Investments, its clients, and the family of Yale Bock have positions in the securities mentioned in the blog, Investing in securities involves risk and the potential loss of ones principal. Past performance is no guarantee of future results. All investment decisions should be considered with respect to ones risk tolerance, return objectives, liquidity needs, tax considerations, and one’s overall financial situation. The fact that Yale Bock has earned the right to use the CFA designation does not mean Y H & C Investments will outperform broad market indexes.