Y H & C Investments February 2024 Update

Horse Racing and The Market- Today’s Odds in the Market!

Return figures in this section come from the January 30, 2024, edition of the Wall St. Journal. Y H & C Investments may have positions in companies mentioned in this newsletter. It is the responsibility of each investor to research the investments mentioned so they can decide on the appropriateness and suitability of the investments consistent with their risk tolerance, risk constraints, and return objectives)

My grandfather, Irving, was a horse racing junkie. He would close his business early on Friday afternoon and fly down to San Diego. For those of you who aren’t familiar with Del Mar, it is a racetrack about 20 miles north of downtown San Diego. He had a membership in the famous Turf Club at Del Mar. Every year, from the end of July until Labor Day, the Del Mar Summer meet is run. Today, they also have a winter event, and sometimes the Breeder’s Cup has been held there. Typically, the first few races at Del Mar are with horses that haven’t run much, one or two times max, if at all. In these races, there is usually an overwhelming favorite, usually it’s because of its parents (bloodlines), or it just ran a great workout time. The odds on these horses winning usually fall in the 1-3 to 1-5 range, but sometimes it is as high as 1-8 or 1-10. It means you will have to wager three to ten dollars to win one dollar. You get very little if you are correct. If you extend this wager into exacta, trifecta, and other type of exotic bets, well, the track usually does well, especially if the favorite does not win.

I bring this up because the closest analogy to the stock market is parimutuel betting at a horse track. Charlie Munger wrote about it extensively in his description of how investors should approach capital allocation. If we look at the current market environment, it is remarkably like the kind of odds we see at the first few races at Del Mar. There are massive companies which have seen their stock prices soar to exceedingly high values. Their shareholders have done incredibly well over the last decade or fifteen years. Factually, over the last year, and the same holds true for the last ten years, if you did not own these companies, you had zero chance of outperforming the S&P 500. You had to overweight them to outperform the market indexes. Ten companies were the source of the nearly all market beating returns.

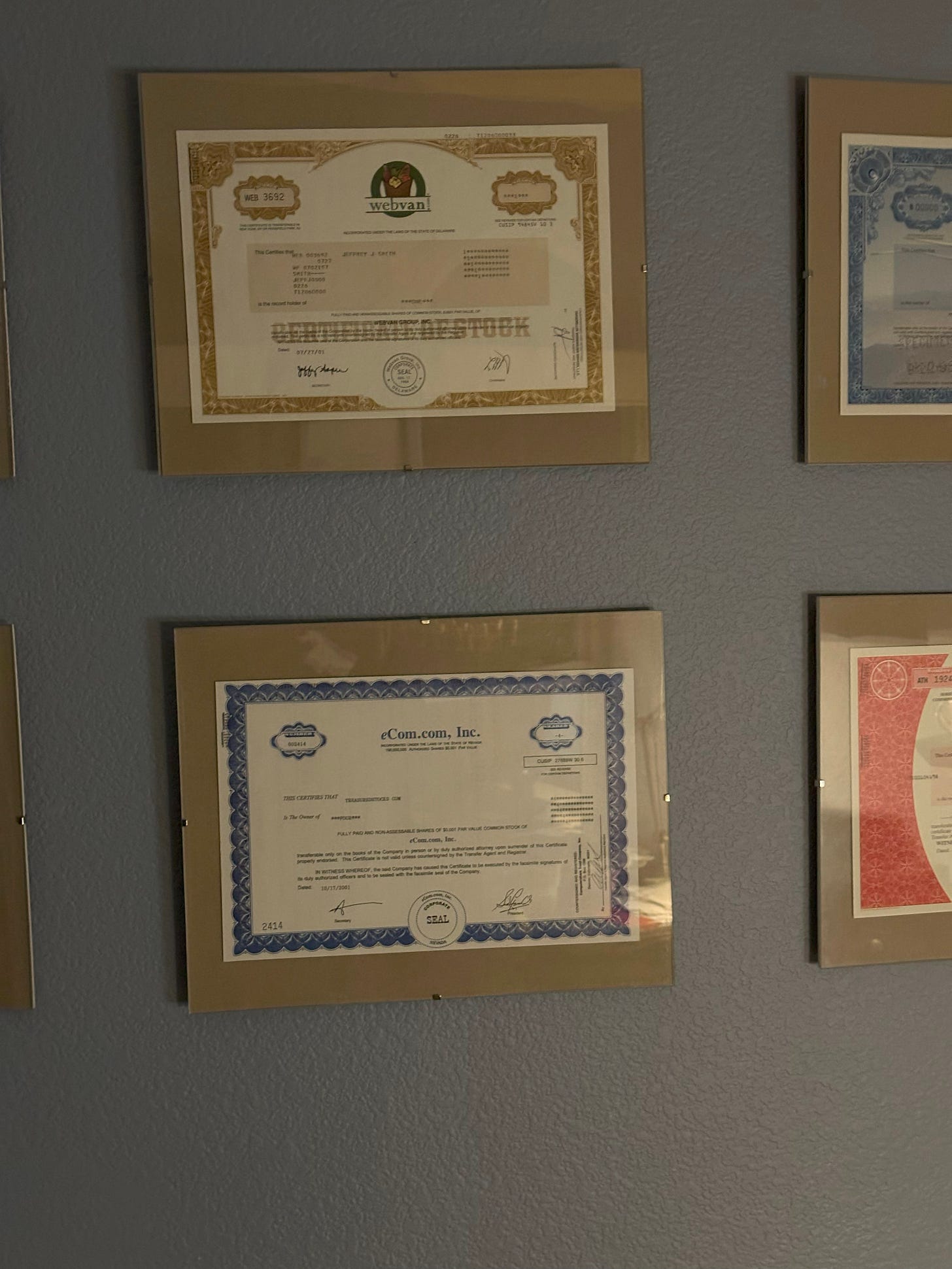

It leaves today’s participants in a dilemma. Do you continue to own these companies even though they are hideously overpriced? As a proponent of trying to get the most one can get for their hard-earned dollars, you know where I stand. It makes me look very dumb when already outrageously priced stocks climb twenty or thirty percent higher in a month. Looking stupid is the nature of investing, especially if you are a contrarian. Some of the most famous events in the stock market occurred during periods when the valuations of specific areas were egregiously extreme. The most noteworthy is Buffett’s speech at the Allen Conference during the internet bubble. Another is when Julian Robertson closed his hedge fund literally a month or two before the internet bubble popped. During that period, great investors lost half of their assets because of they refused to invest in obviously overvalued entities. On the wall of my office are stock certificates from the internet bubble of companies which were at one time worth billions of dollars. They include Webvan, Dr. Koop, and Excite@Home. All eventually went bankrupt. They remind me constantly to be incredibly careful of market fluctuation. Pay attention to the current odds in the market as betting on 1-10 favorites usually is not a favorable risk reward ratio.

Y H & C In January: Coin Collecting and Markets

Much is written about how to learn about investing. Books, on line courses, videos, podcasts, college majors, college graduate school programs, and others are part of the variety of information you can use to try to become a better investor. My own opinion is to take up the hobby of coin collecting. You can start with a book called the Red Book, which you can buy from Amazon for maybe 15 dollars. Why coin collecting and this book? Well, coin collecting forces you to learn about the two primary forces in any market. You must learn about specific varieties of coins and the wide range of possibilities which exist in the market. You also must pay attention to the current market price of the coin and how that might be different than what public information exists. Most important, you need to understand why a coin is priced the way it is. With respect to the stock market, many investors learned about investing by starting in the coin collecting area, the most famous being Mark Cuban, the Dallas Mavericks owner. There is a public company which was taken private a few years ago which I invested in a long time ago. It remains the premier grading service for coins and collectibles. One of the more well-known public micro-cap investors made his reputation as an activist investor by calling for and ultimately having the company eventually get taken private at a much higher price. The business of coin collecting remains a great area to learn about the fundamentals of markets and assets.

As for January, it was a good month for our portfolio. A few large companies have already reported and many others will be telling all over the next few weeks. A couple of smaller-sized companies showed good numbers and their prospects remain bright. Our position in a regional gaming company was a focus as they opened a long-awaited property. Naturally, there were a few hiccups, but it appears they are solved and in time my belief is the new asset will exceed management projections. The smaller sized companies require constant monitoring as there typically is a significant difference between outcomes versus stated goals. Just as important is how quickly a business can scale, which is often the biggest obstacle facing smaller entities. In fact, I have put minimum thresholds on business size to manage risk because too often I see the tiny entities never show any progress with growing the business.

Y H & C Industry & Holdings Update- All We Need Is One! (YH & C Investments may have positions in companies mentioned in this newsletter. It is the responsibility of each investor to research the investments mentioned so they can decide on the appropriateness and suitability of the investments consistent with their risk tolerance, risk constraints, and return objectives)

One of the most attractive reasons for investing in the stock market is that one investment could make a dramatic impact on a person’s financial situation. During the last month, I was introduced to a prospective investment by a contact I have at a small investment bank. They had a conference during the month, and I was able to meet with the company’s management team. Interestingly, they have been to other microcap conferences over the last year and for some reason I did not learn about the story until now. In doing the research on them, they have many attributes which I find ideal. The one thing I want to avoid is becoming too optimistic as it is important to remember optimism can lead to being let down if is not grounded in actual business performance. We won’t know about the success of this for a few years, but all you need is one great investment to make an enormous impact on clients. On that note, the Super Bowl is coming to Las Vegas and our town should be packed, so that is something to look forward to. Thanks for reading the monthly update, and if you have questions or situations I need to know about, please email me at information@y-hc.com

If you think it is worthy, recommending this edition to a friend or family member would be appreciated.

(Y H & C Investments may have positions in companies mentioned in this newsletter. It is the responsibility of each investor to research the investments mentioned so they can decide on the appropriateness and suitability of the investments consistent with their risk tolerance, risk constraints, and return objectives. Past performance is not an indication of future results, and you may lose your principal by investing in stocks.