Y H & C Investments January 2024 Update- Edition 184

2023- Mag 7! 2024- Sag 7?

Return figures in this section come from the November 30, 2023, edition of the Wall St. Journal. Y H & C Investments may have positions in companies mentioned in this newsletter. It is the responsibility of each investor to research the investments mentioned so they can decide on the appropriateness and suitability of the investments consistent with their risk tolerance, risk constraints, and return objectives)

In many ways, being a portfolio manager for yourself, others, or in a position of a professional organization is the same. You are trying to accomplish your financial objectives. You have so much money available. You deploy it with the intent to get the most you can for your money. About six months ago, an old acquaintance of mine, Mark Warkentien, passed away. He was the chief recruiter at UNLV when they built it into a national champion basketball team. He then moved to the NBA and served in various capacities with different organizations. Stien used to say we get one pick a year and it is worth a few million dollars so we cannot screw it up. The same principle applies to managing money for yourself, clients, or enterprises.

If you look at professional sports these days, you have a dual class situation. The haves and the have nots. Interestingly, this year, the have nots performed exceptionally. The Baltimore Orioles in baseball had the lowest salary of all the teams yet won their division. The New York Yankees did not, and their payroll is always amongst the highest in major league baseball. The Los Angeles Dodgers, who just signed two players to over a billion dollars of contracts, won their division but lost in the playoffs. In professional sports, television money has two pieces, national contracts, and local contracts. Large market teams like New York and Los Angeles have huge local contracts with big cable companies that guarantee them hundreds of millions of revenues per year. Small market teams don’t have this arrangement. It is why big market teams get to spend big. Another fascinating point is that two of the best investors in the world, Steve Cohen and Dave Tepper, own franchises in MLB and the NFL. Each had extremely poor years and spent quite a bit of money trying to have successful teams. Just because you spend doesn’t mean you are guaranteed success. In applying the principle to portfolio management, your situation may be similar in terms of what you manage versus others. Instead of having many millions of dollars available, you may have far less. Hopefully, far more, but maybe not. As such, regardless, the goal is the same- make the most of what you have. By doing so, you will wind up with more capital over time.

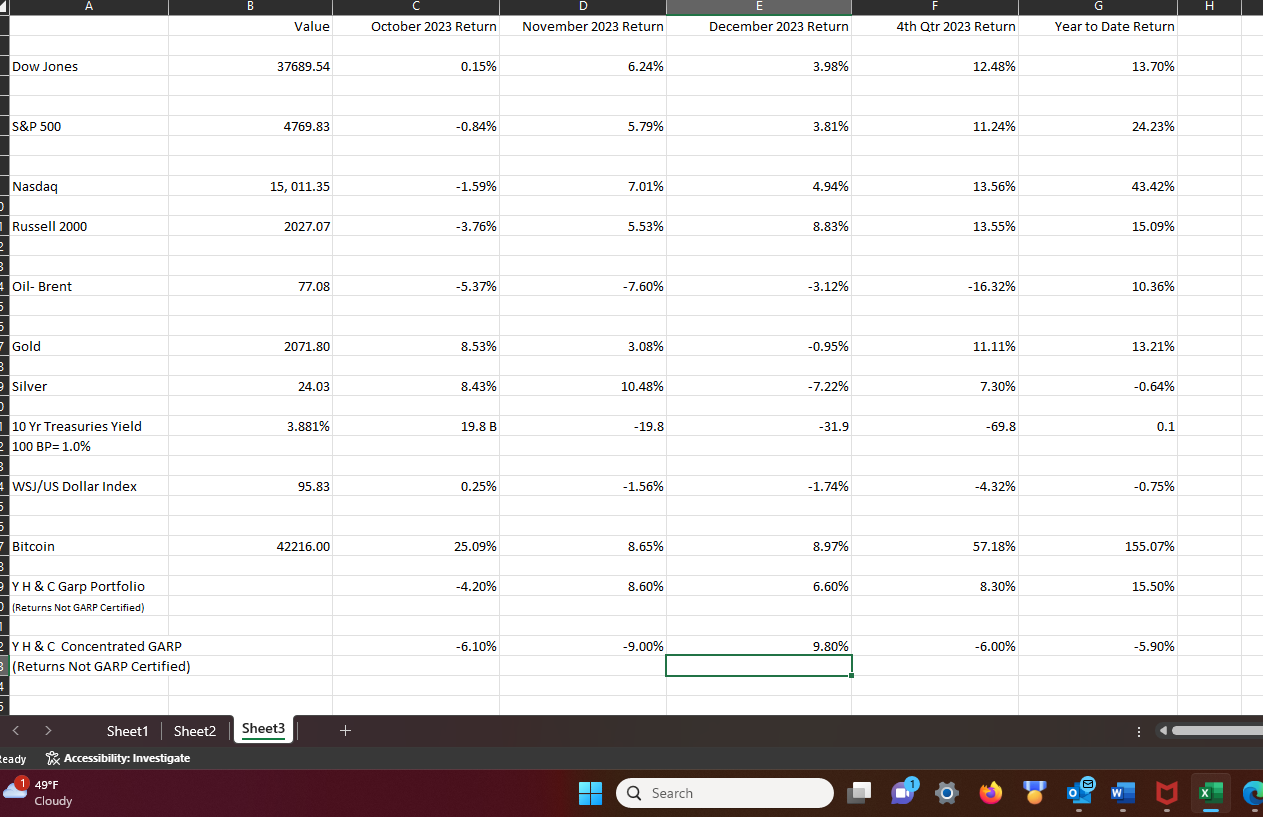

As the year ends, from my perspective, it was a simple one to analyze. It started with the entire world worried about a recession which never came. Coming off a year where markets were down 20%, the institutional mindset was one of preserving capital, and moving assets into the largest and strongest companies. After the bank run in the spring, many of those stocks were down a great deal from the prior year, and those organizations engaged in cost cutting and efficiency programs. Investors ate it up. On the policy front, for two years the Fed has been on a crusade to fight inflation. They operate politically first and are late to the party in recognizing the reality of economic conditions on the ground. In November, once the Fed saw the investment world had done their work for them, i.e., long-term interest rates coming down as the inflation data improved, it was time to change the narrative. As soon as the Fed signaled interest rate policy is shifting (we are going lower), markets took off. You can see it in the fourth quarter and November and December results.

As for next year, with the world knowing interest rates are headed lower, that is now priced in. A big hurdle is going to be the performance of the magnificent seven because their stocks are at a point where business results are going to be nearly impossible to move the needle. They may not drop dramatically, but what is more likely will be years of nothing. Look at Cisco or Microsoft from 2000-2010 for an understanding of this dynamic. More important, what seems compelling? Small caps and financials have done zero for over a decade. Might be a good place to hunt, but if they continue to languish it won’t be because they aren’t cheap.

Y H & C In December: Permanent Vs Temporary Wealth

The companies we own performed quite well during the quarter and especially during December. Once Jerome Powell signaled the change in Federal Reserve policy, our holdings benefited nicely. Of note would be the real estate area, along with many long-time holdings. Our energy positions have had a solid year, even with the price of oil retreating. With that noted, let us mention the market performance and the difference between temporary and permanent wealth.

As I run an advisory practice and not a fund, the results clients obtain are specific to their accounts. Funds are under enormous pressure to beat specific indexes, usually the S&P 500, but it can be whatever is most comparable. Yes, I would like all clients to outperform the indexes, but that is not going to happen every year. My approach is to make sure we are constantly benefiting from compounding. Each year we want to move towards our goals. You do that by making money for clients, or when markets go down, losing them less money. The financial markets are constantly changing and what can be on fire one year may be a horrendous loser the next. Look at the marijuana sector, or SPAC’S, or solar and alternative energy for examples of areas which have seen the bottom drop out recently. Last year, many highfliers in the NASDAQ were down 50%, and this year they are up the same amount. It is conceivable to believe they could go right back down if inflation rears its head again. Building permanent wealth is about owning the equity of businesses you can rely on for not one year, not two years, but for decades. As an example, one of the companies we own for clients is a large insurance company. It had a tough year with costs. Its investment earnings have improved, but the underwriting area suffered. It was a detractor for clients. Are we selling it? No. In fact, I should be adding more. In comparison to say, a high-flying electric car company or artificial intelligence-based technology company, well, the insurance company isn’t going anywhere, today, next year, or the year after that, or the next fifty years. I want to own this insurance company for clients and take my chances with the position over time. Temporary versus permanent.

Y H & C Industry & Holdings Update- Finding an Emerging Star! (YH & C Investments may have positions in companies mentioned in this newsletter. It is the responsibility of each investor to research the investments mentioned so they can decide on the appropriateness and suitability of the investments consistent with their risk tolerance, risk constraints, and return objectives)

Suddenly, I am seeing more predictions that the small company area will have a good 2024. Let’s be clear from my standpoint that is a bit worrisome. I would rather have nobody pay attention to the smaller company area. Over the last five years or so, I have been building positions in enterprises which I think have the potential to become much bigger. It could be from fifty million in revenue to one hundred million, or twenty-five to fifty, or a billion to two billion. The cash generation capabilities would commensurately increase as well. They may not be great businesses today, but my judgement is they are good. I am investing in the thesis that they have the potential to become great. I don’t have to be correct on every holding. If one becomes a great business, well, the rewards will show up. Still, this is a formidable task. One of the challenges of investing in smaller companies is the vast majority are led by people who demonstrate their lack of reliability. Over the last month, at least three companies I monitor raised more money by diluting shareholders as their stocks are hitting a yearly low. Even if I like the management and business, the lack of understanding of good capital allocation mandates I put them on the bottom of my interest list. I own great businesses for clients, and if they aren’t great, they are working towards becoming great. I won’t settle for entities I cannot rely on. 2024 should be an interesting year as far as seeing how the small companies we own perform. I wish you all a happy and healthy year, and if you have questions or situations I need to know about, please email me at information@y-hc.com

Thanks for reading the newsletter this month, and if you think it is worthy, recommending it to a friend or family member would be appreciated.

(Y H & C Investments may have positions in companies mentioned in this newsletter. It is the responsibility of each investor to research the investments mentioned so they can decide on the appropriateness and suitability of the investments consistent with their risk tolerance, risk constraints, and return objectives. Past performance is not an indication of future results, and you may lose your principal by investing in stocks.