(Return figures come from the June 30, 2025, edition of the Wall St. Journal. Y H & C Investments may have positions in companies mentioned in this newsletter. Nothing in the newsletter should be taken as an offer to buy or sell individual securities. It is the responsibility of each investor to research the investments mentioned so they can decide on the appropriateness and suitability of the investments consistent with their risk tolerance, risk constraints, and return objectives)

Bananas are an interesting food for a number of reasons. According to the all-knowing and noted philosopher ChatGPT, its unique characteristics include being nutritionally rich, botanically unusual, widely available, and potentially vulnerable to genetic uniformity. Specifically, bananas are rich in potassium and high in fiber. They contain tryptophan, a parent of serotonin (can boost your mood). Probably more important for those of us with a sweet palate, some of their most noteworthy presentations include the banana split sundae, banana cream pie, banana bread, frozen bananas, chocolate dipped bananas, and the state fair original, fried bananas.

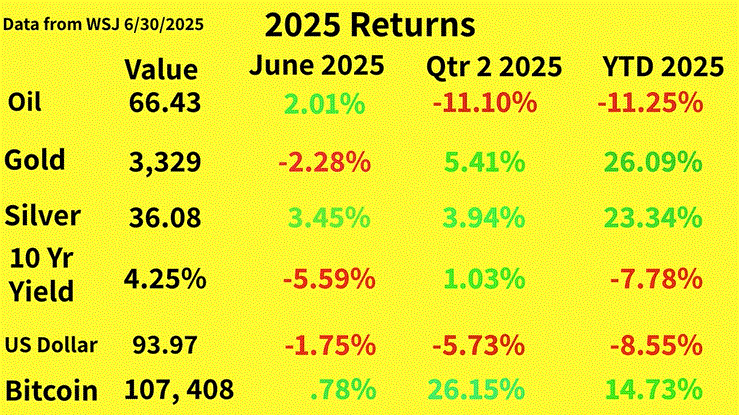

With this information about bananas, a curious reader might be asking themselves, what gives? It is nice you are telling me about bananas, but why does that matter to someone who is interested in the financial markets? Well, I’m glad you are curious. You see, for anyone involved with money, two important considerations are risk and return. In the current environment, where the idea of risk has been frowned upon, what the vast majority of investors care about are the big R. Returns. Returns. Returns. Returns. The only thing that matters, ignoring the two months ago period of April, is you guessed it, RETURNS. I would argue that is an incomplete approach, but this is what we currently have, so let’s link these two subjects, bananas and returns.

According to the legendary businessperson HB, when asked “How is business?” he replied, ‘It is like bananas, it comes in bunches.’ Guess what? The same thing can be said for returns, especially in the capital markets, specifically the stock market. It is my experience that maybe the most difficult part of investing is the long lag time of investment returns relative to when money is laid out to purchase an asset. Stocks can sit dormant for a long time with nothing happening to the price. They will trade in a range which is not glamourous and make no headlines. Note, we are not talking about the underlying business, which is what is important. It is not that the stock is not important, but it ultimately is a reflection of what takes place in the business. Business performs well; stock goes up. Business does not do well, stock goes down. Me Tarzan, you Jane. Oops, I digress.

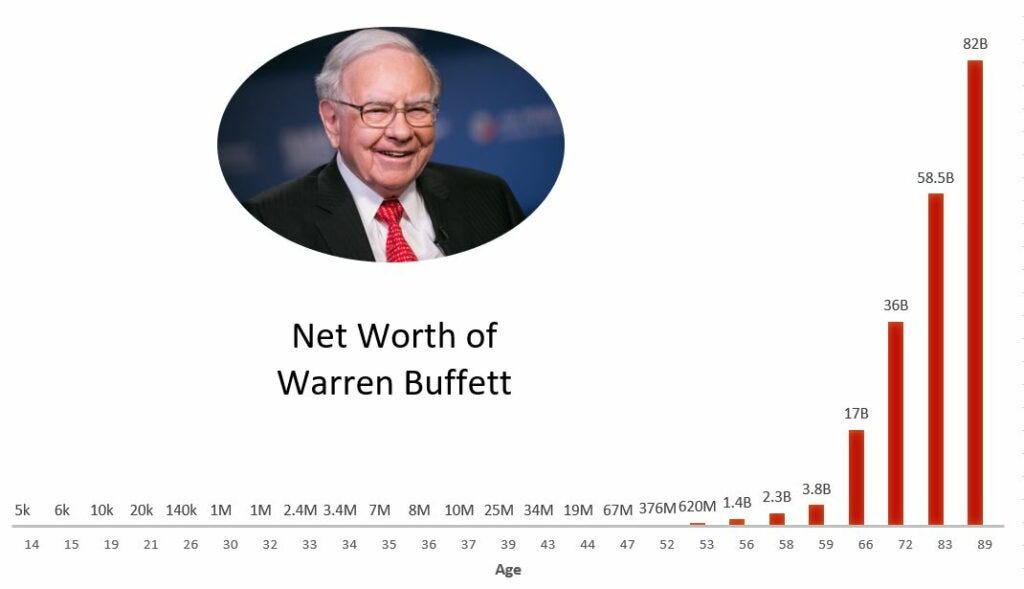

In looking at returns, probably the best example to use is the chart of the net worth of Warren Buffett. Here you go-

One notices those big red lines at the end of the chart. With this astute observation in hand, a key point is the GOAT continued to amass money throughout his career. Buffett constantly saved, tucking businesses and cash away, reinvesting capital into stocks and within each of the owned subsidiaries, and took profits opportunistically. Notice we did not mention tax efficiency. Don’t think Uncle Warren wasn’t tax efficient, either. Growing wealth is actually pretty straightforward: save, invest, save, invest, save, invest, save, invest. Please understand this is a simple but difficult task. It is hard to save, be disciplined, and not worry about keeping up with the neighbors. It is unreasonable to expect anybody to be as good an investor as Warren Buffett. It is reasonable to believe with discipline, one can save, invest, and be patient. Do it for a long time. Try and be understanding about the unpredictability and timing of returns. Remember, they come in bunches, just like bananas.

Spanning the Globe: Events of the Middle East

June was a remarkable month in the Middle East. With the bombing of the large nuclear facilities in Iran, Israel and the United States forced a cease fire with the world’s leading sponsor of terrorism. The implications for the future are potentially enormous. First, there is a chance the region could see a sustained period of peace for a long time. It is possible many Arab countries, specifically Sunni based, will line up to join the Abraham accords and want to have a multi country agreement with Israel. One thing we do know is Iran has militarily been neutered. Whether the current regime stays in power remains to be seen, but certainly they are dramatically weakened and potentially vulnerable to a quick change of leadership. Time will tell on that front and things could go haywire at any moment, so the world is most certainly paying attention.

Economically, the major implication is in the energy markets. Taking a regional conflict off the table means any war premium in the price of oil may disappear. Lower energy prices are a good thing for many countries and for the global economy. Relatedly, with the investment world agog in the growth possibilities of artificial intelligence, a little second order thinking is needed. If AI is going to become the be all and end all of everything with use cases in every industry, the demands on the electrical grid will be enormous. Utilities are currently afforded a premium in the markets because of this projected demand. In order for it to happen, the utility industry needs the power generation capabilities from some input. Guess what those inputs probably are? Natural gas and coal, and maybe some nuclear. The most obvious one is natural gas. What entities produce a great deal of natural gas? Yes, you guessed right, the largest oil companies. It very well could be the biggest beneficiary of the AI boom are the big bad energy companies. Hope I got you thinking!

Elsewhere, the 32 NATO countries agreed to increase defense spending of up to 5% of GDP by 2035. President Trump and the position of the United States played a large part in pressuring the leaders of NATO to understand why this is important. Here in North America, there remains continuing disagreement between Canada and the United States about trade and tax policy. The most recent spat involves a digital tax levied by Canada in the technology arena (it appears Canada caved tonight). The rest of the globe seems to be lining up to strike agreements with the Trump Administration, and by the end of the summer one gets the sense the trade situation should mostly be settled.

On the domestic front, the big, beautiful bill looks as if it will pass through the Senate by July 4. Reconciliation waits for a final product that President Trump will undoubtedly be very happy to sign. Two areas of the bill I am paying particularly close attention to are the Medicaid piece and the alternative energy tax credit eliminations. The Medicaid portion is important because the Democrats will probably attack Republicans as being heartless monsters for taking away Medicaid from grandma while doling out tax cuts to the rich and blowing up the national deficit (as if the Democratic party was devoted to the religion of fiscal prudence). With the alternative energy tax credits, those segments of the market have been crushed, and some believe the long-term prospects are still quite attractive.

Y H & C Investments Firm Update-

Consistent with the theme of bunches, across the Y H & C position universe there were a number of holdings which performed nicely. One thing I want to emphasize is when an asset management firm owns a large number of holdings, not every client can own every position which does well. A small asset management firm like mine is structured so clients have their own separately managed accounts. Each portfolio is tailored to fit the client’s specific situation. Larger asset management firms often create mutual funds where assets are combined into one specific structure. They have a unified worth, called a net asset value, which is quoted as the fund price. It is not tailored for any specific client. Mutual funds are phasing in their own exchange traded funds, which are more tax efficient than traditional funds. My firm is not at the scale to create a mutual fund or ETF, so separately managed accounts is the current account structure in place.

On a separate matter, last month a friend messaged me telling me congratulations. I did not know what for, but he mentioned that both the models I manage at Interactive Advisors were in the top five on the platform for performance over the last year. Here is a link to the page if you are interested. I would note that consistent with the bananas theme, these models’ results are in bunches, and the last few years were a bit dormant. One is heavily concentrated while the other not as much. Once in a while you can pat yourself on the back but with stocks when you do, it can get taken away pretty quickly. Better to remain cautiously optimistic.

We were introduced to some new investment possibilities at the Centurion One Beverly Hills conference, so thank you to the team there for inviting me to such an outstanding event. It’s always good to meet and spend time with great people while you widen the potential investment universe. June was a good month for some of our holdings in the small and micro-cap area. These positions often take a long time to work and sit idle for lengthy periods, but when they post good results or for some reason attract investor interest, there can be dramatic changes (both good and bad). The key point to keep in mind is owning companies which are building their businesses to constantly grow the cash generation capabilities. It often requires investment which may take time to reap the benefits. In these cases, one does not see immediately improved results. In many situations, they are working on lengthy projects which can take a year or two to materialize. Like a military constantly working to defeat adversaries, this requires a long-term time horizon. When, not if, is what matters. It requires keeping the faith.

July will be a travel month for me but with earnings season a few weeks away, there is never a break in the financial markets. In the meantime, with the hot summer months ahead, you might take the time for a nice treat to cool your palate, maybe a banana split! Thank you for reading the June update, I really appreciate it. If you have any investment questions, please reach out to me at information@y-hc.com.

(Y H & C Investments may have positions in companies mentioned in this newsletter. Nothing in the newsletter should be taken as an offer to buy or sell individual securities. It is the responsibility of each investor to research the investments mentioned so they can decide on the appropriateness and suitability of the investments consistent with their risk tolerance, risk constraints, and return objectives)