Y H & C Investments October 2023 Update- Edition 181

Are Markets Delusional About How the US Currency Is Valued?

Dollar Delusion: Should the Dollar Be Strong and Why it Matters?

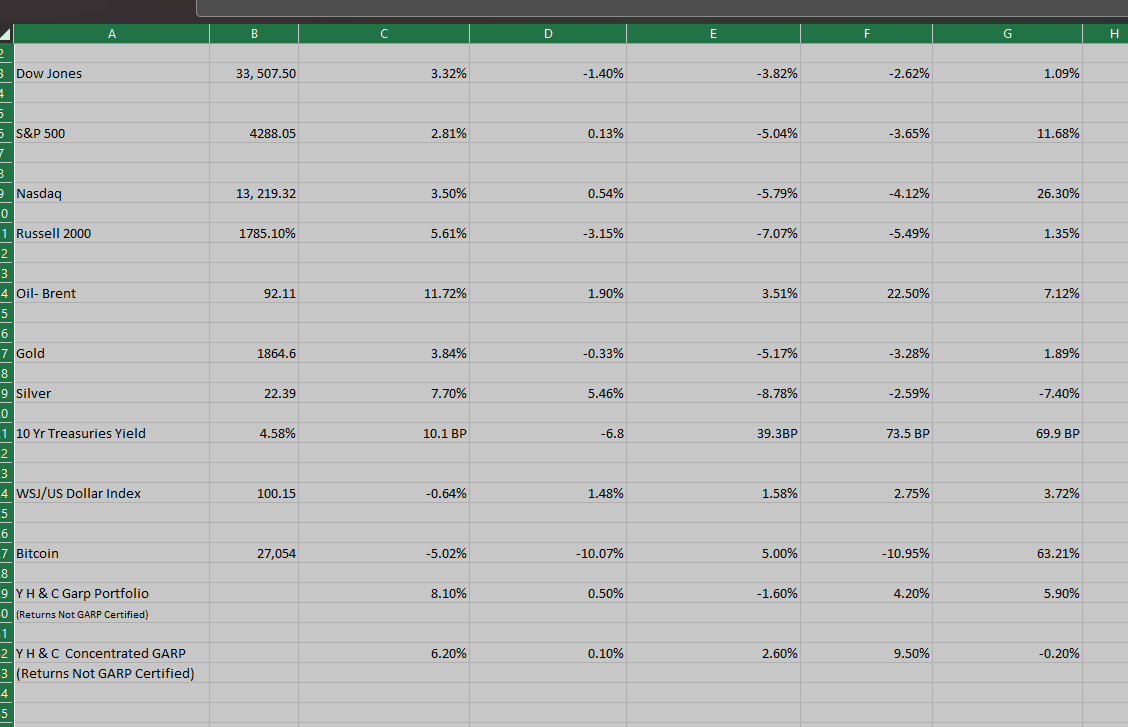

Return figures in this section come from the September 1, 2023, edition of the Wall St. Journal. Y H & C Investments may have positions in companies mentioned in this newsletter. It is the responsibility of each investor to research the investments mentioned so they can decide on the appropriateness and suitability of the investments consistent with their risk tolerance, risk constraints, and return objectives)

In the always changing world of economics, interest rates are a constant focus. Interest rates are the cost of money, and they are the discounting mechanism in calculating what any asset is worth. As has been the case for decades, the Federal Reserve sets the tone for the world on interest rate policy. It has raised interest rates over the last year where the ten-year treasury bond is just under 5%. Historically, that is very much in line with traditional borrowing costs of 5-7%. Relative to Europe and Asia, it is higher than most of their rates. Because of this, and the fact that the US economy is viewed as a faster growing and more reliable economy, the demand for US dollars remains high. Nowhere in this analysis is included the 33 trillion-dollar debt the US currently owes, nor the two trillion-dollar deficit the country is running. With the current level of interest rates, it means the US will now have to pay around 1.5 trillion dollars of annual interest per year, nearly a trillion more than the same time last year. The level of interest rates affects the demand for all assets, and increasing rates makes the bar to own risk-based assets like stocks and real estate higher. Why own riskier stuff when you can earn greater interest on cash and bonds where you are a creditor or have no risk? Investors have answered the question by currently turning away from risky asset classes like stocks and real estate. However, over a longer period, the current fiscal situation of the United States will change the dynamic, for both interest rates and the value of the dollar. As it does, the perception of risk-based assets will move as well. It is why I said the always changing world of economics.

Y H & C In September- Taking a Drive

Driving is a dangerous but necessary activity. You learn the rules of the road, take the mandatory tests, and if you prove you are capable, you earn the right to drive a three-thousand-pound vehicle. There are as many kinds of drivers as there are people in the world. Superior drivers plan their routes, are safety conscious, and use well maintained equipment and cars. The most difficult driving decisions usually involve a left turn into oncoming traffic. Many accidents take place where the left turn wasn’t driven correctly. Obviously, during these accidents, the driver chose a time to make the turn which didn’t give them enough room relative to oncoming traffic. When driving, judgement and patience dictate when to turn and not turn, stop or go, and accelerate or brake. Hmm, these characteristics sound useful in many other areas of life, don’t they?

Driving can be quite enjoyable when done correctly. Having lived in Southern California for many years, I understand why many people love driving along the Pacific Coast Highway near the Pacific Ocean. I often made the drive from San Diego north to Orange County and Los Angeles, and vice versa. The same holds true along the Monterey Coast and in northern California, too. Driving and enjoying the scenery of beautiful areas is applicable to all areas of the world. With few stop lights and long stretches of beauty, one can have long stretches of time where the world is a wonderful place. Let’s turn to what happened in financial markets and specifically our holdings at Y H & C Investments.

Y H & C Industry & Holdings Update- Looking Under the Hood! (YH & C Investments may have positions in companies mentioned in this newsletter. It is the responsibility of each investor to research the investments mentioned so they can decide on the appropriateness and suitability of the investments consistent with their risk tolerance, risk constraints, and return objectives)

September was a month where the market did not reward our ownership of equities, similar to most other stock market participants. Anything we owned was viewed negatively. As market participants believe interest rates will be higher for longer, anything related to real estate suffered. It does not matter how good the real estate assets are, or how successful the management teams of those assets have been, they were viewed unfavorably. One management team made an unforced error by engaging in what they considered a good long-term decision to sell their office properties in a spin-off. Time will determine how good the judgment is, as well as the effectiveness of future capital allocation decisions. In another area of the market, anything small is seen as an unfavorable asset

. Investors are not looking under the hood of companies to see how the situation is changing. In our companies, they are working on finding ways to bring more money in, and keep more of what comes in. It may be opening a new hotel and casino, new apartment complexes, instituting enterprise software to analyze return on investment or protect against financial fraud, or plenty of other aspects of a business. In quite a few cases, management executives bought shares in their companies in the open market. You can view those purchases how you want to, but certainly, it is not a bad thing to have executives showing faith in the company they work at.

As an example of how the industry can determine how a stock is performing, the energy industry is now regarded favorably as currently, energy prices have headed higher. We own a large integrated energy company where the CEO had to resign because he did not disclose prior personal relationships. The company is massive and has overcome enormous obstacles over the last decade. It is highly profitable (20-30 billion in yearly cash flow, or more), and owns strategically critical assets all over the globe which cannot be replaced. It is logical to question the oversight of the board for directors for not doing enough due diligence on the ex-CEO. Interestingly, the stock has risen, but the company has been buying back the stock for many months. Still, it shows you the industry can affect the stock performance.

We want to own companies which have plenty of years of profitable growth ahead, like taking an uninterrupted drive along a beautiful part of the country. You can have many years of enjoyment in both situations. Given the management teams, their market position, the condition of the assets, and the improvements which are constantly being implemented, I remain confident in the journey ahead, both in the markets and as a driver.

Finally, as far as the ongoing transition to the Schwab platform from TD Ameritrade, it appears Y H & C clients are happy with the status. The issues which I learned about have been addressed and solved. If you have questions or problems I need to know about, please email me at information@y-hc.com

Thanks for reading the newsletter this month, and if you think it is worthy, recommending it to a friend or family member would be appreciated.

(Y H & C Investments may have positions in companies mentioned in this newsletter. It is the responsibility of each investor to research the investments mentioned so they can decide on the appropriateness and suitability of the investments consistent with their risk tolerance, risk constraints, and return objectives. Past performance is not an indication of future results, and you may lose your principal by investing in stocks.