Y H & C Investments September 2023 Update- Edition 180

The Magnificent 7, and Why Baking Is Applicable to Investing

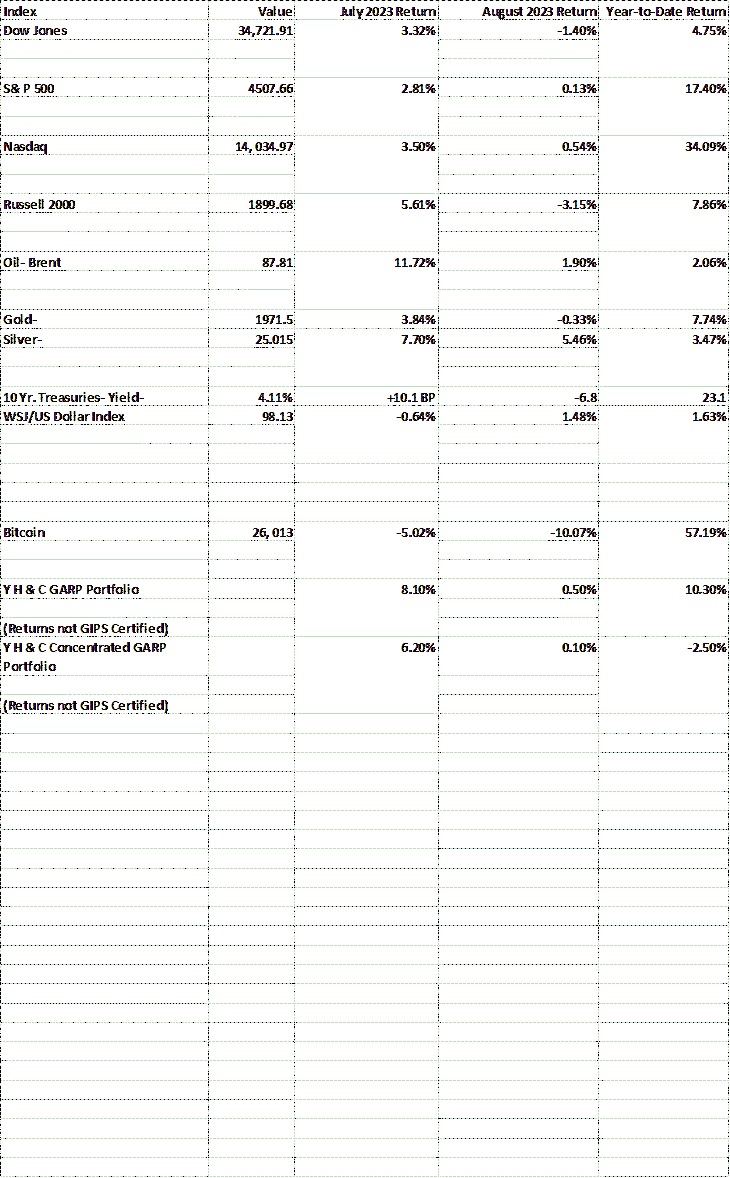

Are the Magnificent Seven So Magnificent?(Return figures in this section come from the September 1, 2023, edition of the Wall St. Journal. Y H & C Investments may have positions in companies mentioned in this newsletter. It is the responsibility of each investor to research the investments mentioned so they can decide on the appropriateness and suitability of the investments consistent with their risk tolerance, risk constraints, and return objectives)

Many kids enjoy reading and collecting comic books. My brother is maybe the most dedicated collector of comic books of anyone on the planet. Comic books have done particularly well as investments, and there are different ways to approach investing in comic books, otherwise known as collectibles. One of the most famous comic book episodes is called The Magnificent 7. They were comprised of legendary characters like Superman, Wonder Woman, and Batman. Interestingly, I bring up the magnificent 7 because of its applicability in the stock market.

You see, over the last two decades, the most important decision for any fund manager has been have you owned the largest tech companies (I am sure you can figure out what they are), and how many of them relative to your benchmark? The reason is because 70% of all the outperformance of the stock market over the last decade is attributable to these names. If you owned them in a big way, you outperformed the market. If not, uh, no chance. The important question for investors is will the magnificent seven continue to be so fabulous over the next three, five, and ten years?

My own opinion is no, and I have invested away from these juggernauts. The reason why is because at the current price investors are paying, the owner does not receive a great deal. As a relative comparison, the current risk-free yield on a 10-year treasury is a little above 4%. If we take a comparable company, say Shopify or Spotify (admittedly not in the Magnificent 7 but for our purposes they work), you will receive less than this 4%. When I say receive, I am referring to the operational results of the business. Investors are hoping the growth of these companies will justify the price. Time will tell, but if the growth falls a little short, it will be difficult to earn a ‘magnificent’ return.

Y H & C In August- Learn from Baking

When you are a kid, one of the great pleasures in life is helping your parents (usually your mom) bake a cake or cupcakes. You begin by taking out a bowl and adding your mix. Other ingredients involve flour, water, eggs, butter, and maybe some cream. The next step is to mix the batter, either by hand or with a blender. Good bakers make sure the batter is poured evenly with no waste and done neatly. After it is nice and smooth, it is poured into a holder and then delicately placed in the oven. After the cake is in the oven, the all-important step of making the frosting begins. The process is like cake, only the mix will be different, and sugar probably is an ingredient, and maybe some flavoring. Once the cake is done baking, the frosting is added to the cake (cupcakes). It is spread out evenly, neatly, and often contrasts with the cake mix. If the cake is chocolate, the frosting is vanilla, and vice versa. For kids, the best part of the baking process is licking the bowl. This takes place after the cake and frosting are poured. The most important part of baking to remember is you only evaluate how good the cake is when everything is done, including the baking. Crucial to the evaluation is not just how it tastes, but how it looks, as people eat with their eyes! Why is this important with investing? Read on to discover why.

Y H & C Industry & Holdings Update, and the TD Ameritrade- Schwab Transition! (YH & C Investments may have positions in companies mentioned in this newsletter. It is the responsibility of each investor to research the investments mentioned so they can decide on the appropriateness and suitability of the investments consistent with their risk tolerance, risk constraints, and return objectives)

In August, we had several situations where companies we own positions in have sold off and gave back gains from earlier in the year. Clearly, that is disappointing, but perspective matters with investing. When you bake a cake, you only evaluate the result when the entire process has taken place. With our investments, each situation is unique, but all are in the middle of a major initiative which they have been working on for years. In one case it is building a customer base and opening a new casino and hotel in a few months. In another, transitioning an acquired company and finishing up the integration of another large enterprise are still ongoing. Smaller companies have more volatility because their results are greatly impacted by these ongoing initiatives. In the current environment, when a slight miss is punished harshly, selloffs take place. The ongoing monitoring of the companies and how the execution compares to their stated plans is like watching the cake in the oven.

A few of the very small companies also decided to raise capital after their stocks appreciated. It is one of the consistently frustrating aspects of owning microcap entities is their willingness to raise capital at the drop of a hat.

For existing clients, this weekend marks the transition of accounts from being custodied at TD Ameritrade Institutional to Charles Schwab. You should have received an email from me regarding the approach. I will be actively monitoring it over the next week (and month) to make sure it goes smoothly, and clients are happy with the transition. If you have questions about it, please email me at information@y-hc.com

Thanks for reading the newsletter this month, and if you think it is worthy, recommending it to a friend or family member would be greatly appreciated.

(Y H & C Investments may have positions in companies mentioned in this newsletter. It is the responsibility of each investor to research the investments mentioned so they can decide on the appropriateness and suitability of the investments consistent with their risk tolerance, risk constraints, and return objectives. Past performance is not an indication of future results and you may lose your principal by investing in stocks

)